Recipe for Business Growth

The Recipe for Business Growth

Start with passion, add a splash of hard work, and scale up. This is the recipe for business growth, but there’s a bit more to it than that.

You ever heard this story? Your neighbour Barbara sells bread and cakes from her home on a Sunday evening. The smell of freshly baked goodies is so enticing, soon she’s baking bread every evening just to keep up with the line of neighbours who come calling. Word spreads like a hot knife through butter and before you know it, Barb’s bought a container and set up a semi-permanent micro bakery at the top of the gap with a beautiful sandwich board sign and a line of customers down the street. Great! Business is booming for Barbara the home baker!

While booming business is great, remember that every step forward has new obstacles to be conquered. Scaling a business is tough work…but you can do it!

Your first step is to ask yourself - what’s your big goal?

Barb’s big goal is to grow her business to the point where she can leave her day job, and still have a comfortable and relaxed retirement. And doing something she loves is what will get her there! Let’s take a closer look at how Barbara was able to scale up her business.

Shake the money tree

To level up from hobby to business, you may need an investment or loan to buy new equipment, supplies, machinery or to develop the technology you use. When she started selling every day instead of just Sundays, Barbara realised that her home oven couldn’t cut it anymore. She needed an industrial oven with more output. She also needed new cake molds to expand her product line and vertical racking to cool dozens of cupcakes without taking up more counter space. Equipment costs money that you just might not have up front.

Entrepreneurs benefit from a number of financial options like crowdfunding, a business loan or angel investment. There are pros and cons to all. With an angel investment for example, you may have to give up equity in your company. Weigh up the option that’s best for you.

Find out more about affordable small business loans

Now imagine if Barbara’s bakery didn’t depend on her doing it all herself? That’s the dream isn’t it? When executing day-to-day functions, many business owners wear blinkers, trying to develop their talent and sell the product they believe in. It’s hard to find time to focus on other important tasks like financial goals, marketing or accounts. That’s why you’ll need your A-team.

The rewards of building a team

You’ll find it difficult to build a successful business if you’re a jack/jane of all trades. Remember - being a great baker doesn’t mean you’re a good accountant, and outsourcing the jobs you don’t have skills for is a good move for your business in the long run.

The course of evolution from ‘hobby’ to ‘small business’ naturally results on needing a team to support you and take on some of your tasks.

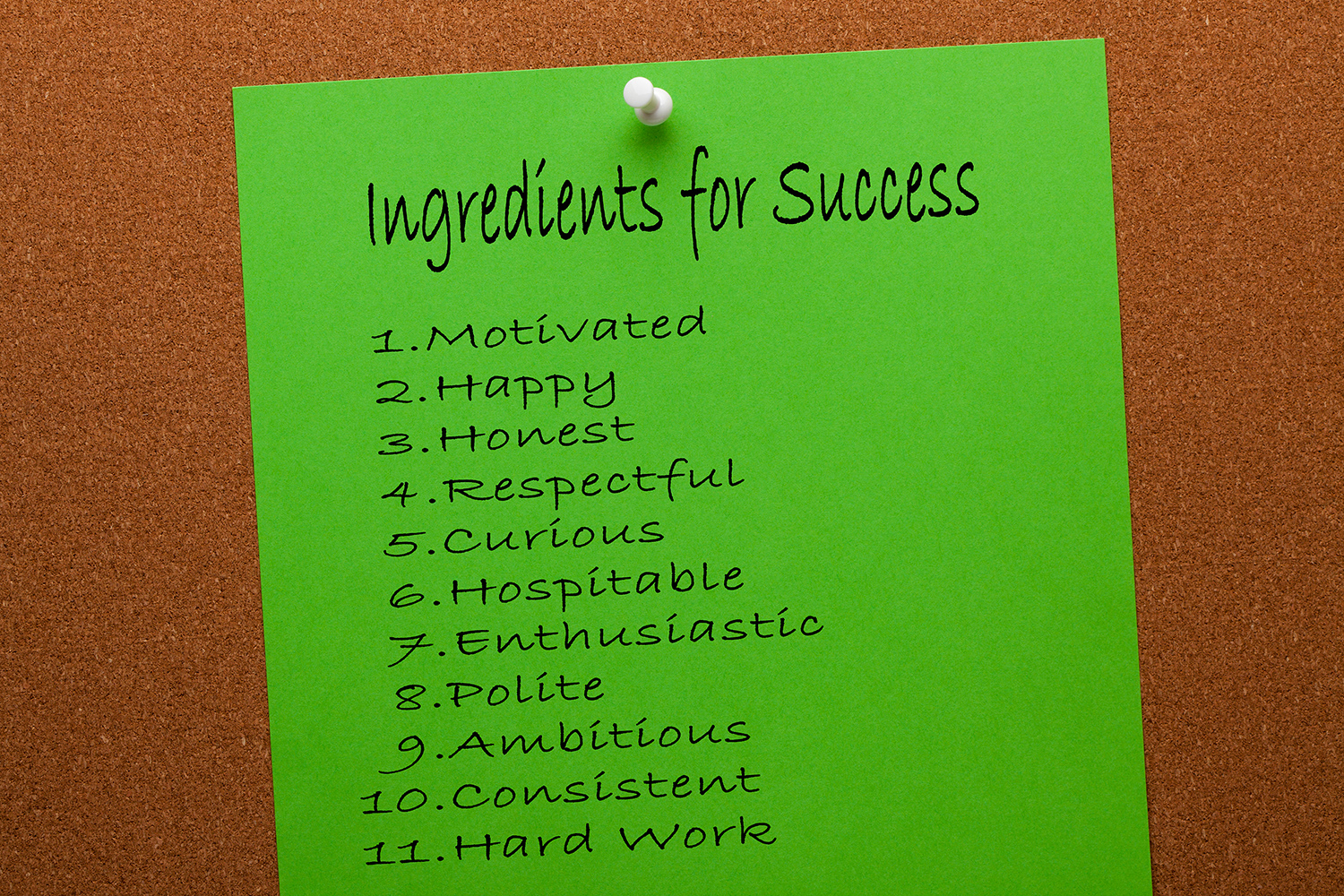

When building your team remember…it’s your team. They should carry your vision, deliver on your mission statement and have skills that you don’t. With specialists focusing on specific tasks (instead of Barb being a jane of all trades) your company’s cogs will turn more easily. If Barbara can hire a qualified and charismatic sales rep to tackle the everyday grind in the shop, she can use her time more efficiently in the kitchen.

Aligning yourself with like-minded entrepreneurs with similar passions will also help to catalyze your drive to dedicate your time to business goals while your business handles itself. Now isn’t that a great feeling?

Invest in technology

Part of scaling your business is answering the question “How can technology make me more efficient and help me reach more customers?” Well, here are a few answers:

- Using machinery to automate processes helps you avoid doing things by hand, freeing your staff for other tasks.

- Technology can help you target more customers in new ways – for example, with digital marketing Barbara can target potential customers who live near to her shop, at the time of day when they might be feeling hungry, or if they’re celebrating a wedding (and might need a fabulous cake!)

- It makes it easier to get paid. For example, as a CIBC FirstCaribbean client Barbara may choose to receive payments via our mobile app. It’s quick and efficient for her customers who don’t want to carry cash, and funds are directly credited to her account. As an alternate to wire transfers, she can also use 1stSend with Online Banking to pay international suppliers at any time, without ever going in-branch.

Find out more about accepting online payments

Scaling your business requires two things: the capacity to grow and the capability to support growth. When the neighbours started showing up every evening to see what she was baking, Barb demonstrated “capacity to grow”. Her “capability to support growth” came from hiring a few key team members to take over the front of shop and accounting and marketing duties.

There is an art to scaling your business once you believe in your value as an entrepreneur. And if you’re like Barbara and choose to do something you love – well that’s the icing on the cake.